NFT gaming is here to stay; Crypto world regains momentum; Zero-knowledge proof - Revolutionising Layer 2 scaling

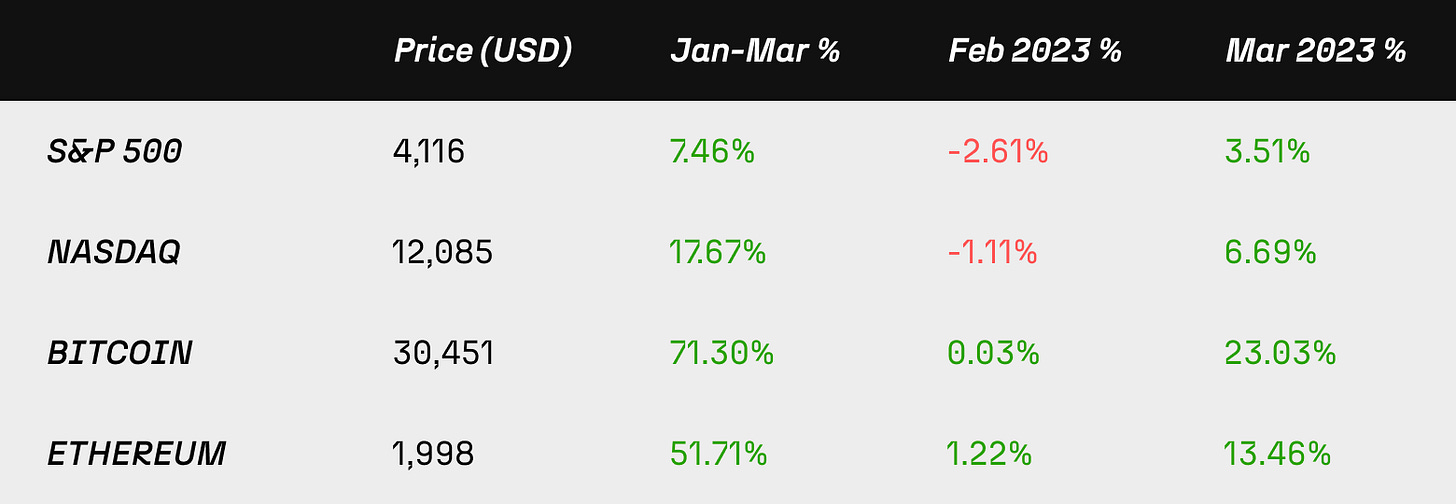

MARKET OVERVIEW

It's remarkable that merely a month has passed since our last newsletter. More people than ever now appreciate the significance of a decentralised store of value like crypto, primarily due to the Fed's shortcomings. The U.S. Government has taken note of crypto's potential and is beginning to comprehend what's at stake (i.e. everything). Yet, they struggle to keep up with its rapid evolution, and their reliance on traditional models may prove futile. Fear, born from a lack of understanding, suggests we can anticipate a bumpy road ahead as regulation and innovation collide.

In spite of bank failures and the Fed's unanticipated hawkish stance on interest rates, equities finished strong in March, and crypto persevered, even as some governments sought to restrain its expansion. The Fed's put is back in play, but it directly works against efforts to tame inflation.

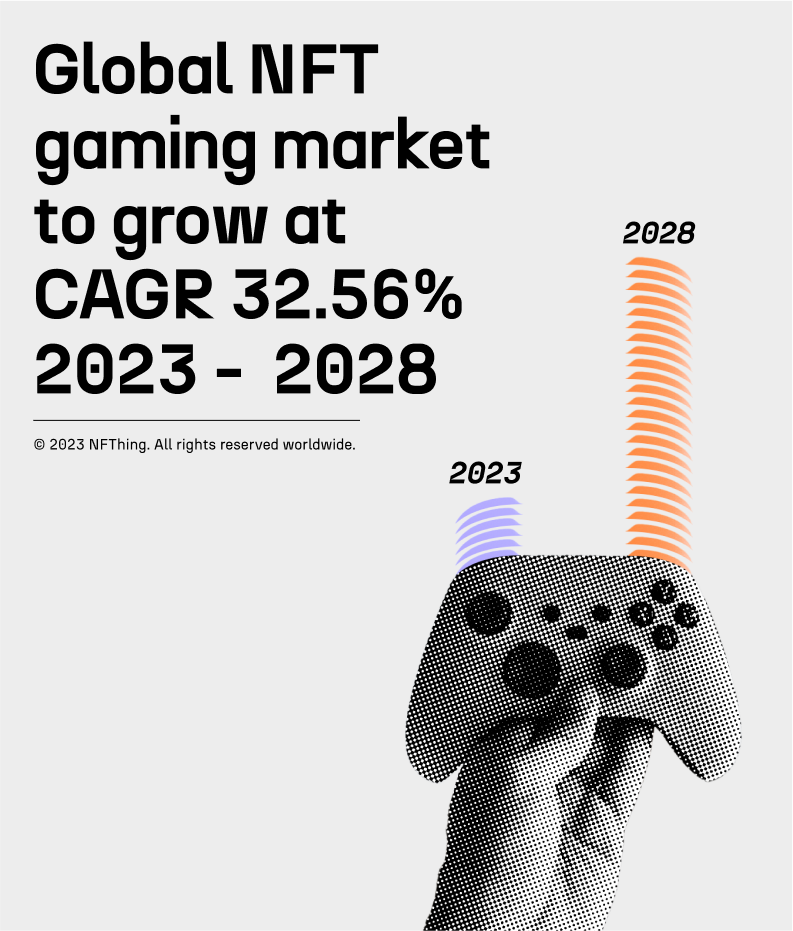

1. NFT gaming is here to stay: From Messi's $21M funding in an NFT football game to Sony's adoption of NFTs

The gaming industry now surpasses the combined size of the music and film industries, and it is within this domain that we believe rapid NFT adoption is likely to occur. NFT gaming, which closely resembles the metaverse, introduces a wealth of opportunities that did not exist before. For example, NFT gaming has enabled the "play-to-earn" concept, allowing players to earn money by purchasing/winning and trading in-game items, characters, or collectibles. This approach not only enhances engagement but also enables players to earn money while enjoying their favourite games. Additionally, the convenience of interoperability empowers players to transfer their digitally owned assets as NFTs both within and beyond games. Why shouldn’t we be able to use a skin we purchased in multiple games = metaverse?

These advances have caught the attention of not only gamers but also well-know businesses eager to explore this burgeoning industry. Numerous play-to-earn startups have entered (some have already exited), and now, larger established brands and studios are taking NFT gaming seriously. Matchday, a football-centric Web3 gaming startup, is a prime example. Backed by $21 million in VC funding from Lionel Messi, Matchday aims to create a new gaming category for the 5 billion football fans worldwide. Players can buy or trade player card NFTs to enhance their squads and compete with others. During the 2022 FIFA World Cup, Matchday distributed 2 million NFT player cards to approximately 600,000 users via a mini-game.

Messi's involvement in the NFT world extends beyond Matchday; he also serves as a brand ambassador for Sorare, an NFT fantasy soccer game, and Socios, a fan token firm. In 2021, Messi even launched his official NFT collectibles through the Ethernity Chain platform.

More established brands, such as Sony are now entering the space, integrating blockchain technology and NFTs into their gaming environment. In November 2022, Sony filed a patent titled "NFT Framework for Transferring and Using Digital Assets Between Game Platforms". This patent allows players to transfer in-game assets between devices and platforms, granting gamers ownership of in-game skins, avatars, or other items across multiple gaming consoles. Needless to say, Sony has the potential to transform the gaming industry, and others will have to follow suit.

As NFT gaming expands, some major players such as Mojang Studios (Minecraft developer), Rockstar Games, and Ubisoft Entertainment, remain hesitant to adopt blockchain technology. Hardcore gamers argue that NFTs and tokenomics can detract from the fun of gaming, turning it into a money-making scheme. However, as NFTs continue to gain traction, it's worth considering whether players who have invested years in a game should have the right to trade their in-game assets and even do so across different games.

2. Crypto world regains momentum: Traditional financial system in trouble… again!

The global banking system trembles as Credit Suisse and regional U.S. banks collapse, causing the public's trust in banks to falter and Moody's to downgrade the U.S. banking system to "negative".

The collapse

Top U.S. banks such as Silicon Valley Bank (SVB), Silvergate Capital, and Signature Bank experienced collapses that sent shockwaves throughout the nation's regional banks. The Fed maintained extremely low interest rates for a prolonged period, prompting banks to invest in longer-dated treasuries with higher returns. However, the Fed rapidly raised rates (from 0.25% to 4.50%) in under a year, leading to mark-to-market losses for banks. At the same time, bank depositors, who had funded the treasury purchases, demanded their money back, fearing losses due to the banks' deteriorating liquidity situations. This chain of events resulted in the failure of several local banks and the subsequent transfer of money from local to larger institutions.

Credit Suisse, Switzerland's second-largest bank, faced even greater challenges due to its involvement in multiple scandals, including the collapse of two investment funds. UBS acquired Credit Suisse for around $3.3 billion, less than the valuation of Yuga Labs, creators of the Bored Ape Yacht Club NFT project.

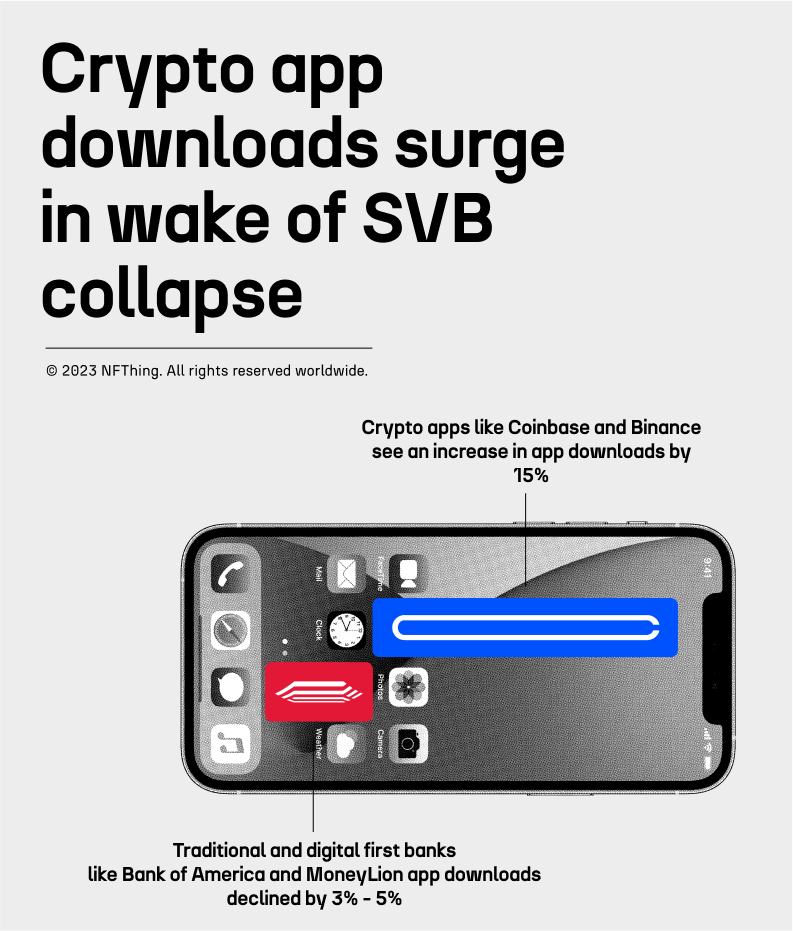

Crypto adoption

As prominent U.S. banks like Silvergate Capital, Silicon Valley Bank (SVB), and Signature Bank faced shutdowns, app downloads for the top 10 traditional banks (including Bank of America and Capital One) and top 10 "digital first" banks (such as Dave and MoneyLion) declined by 5% and 3%, respectively. In contrast, after the SVB debacle, former Bitcoin.com CEO Stefan Rust noted a "positive contagion" in the crypto market, as downloads for the top 10 crypto applications (including Coinbase and Binance) increased by 15%.

The U.S. banking sector's vulnerability highlights the need for a decentralised monetary system and, at a minimum, suggests that people should diversify their savings into alternative systems. This is further supported by the likelihood of the Fed continuing to inject more dollars into the economy, leading to currency devaluation. Diversifying into crypto assets, such as Bitcoin with its well-defined rules and resistance to manipulation, becomes a more attractive option. In the context of hyperinflation and the deflation of the U.S. dollar, renowned investor Balaji Srinivasan predicts that the price of a Bitcoin will reach 1 million USD by June 2023 - you’ve got to love the Silicon Valley show.

CBDC adoption and fear

Countries around the globe are actively developing and implementing their Central Bank Digital Currencies (CBDCs). Although similar to cryptocurrencies, CBDCs differ in that they are backed by the issuing government. This development represents a significant shift for governments, potentially disrupting traditional banking or at least greatly diminishing its importance.

Various governments are taking different approaches to CBDCs, creating a race to establish a new reserve currency for the nation that gets it right. However, we anticipate that governments will proceed cautiously with this transition. For example, the Bank of England aims to promote the digital Pound by limiting individual holdings to 10,000 GBP per person. As users grow more comfortable with digital currencies and appreciate the low fees they offer, embracing a more decentralised framework will likely become a more manageable step.

In a world with widespread CBDC adoption, there would be no need for intermediaries like Stripe, Revolut, Visa, and others, which currently contribute to the expense and slowness of financial transactions. This evolution in currency could lead to more streamlined, cost-effective financial systems globally.

3. Revolutionising Layer 2 scaling: Zero-knowledge proofs boost Ethereum’s speed and affordability

The growing number of Decentralised Applications (DApps) on the Ethereum network has led to scalability challenges, including a limited transaction rate of 15 TPS and increasing gas fees. To make Ethereum more accessible for widespread use, scaling solutions are crucial. One approach involves adding Layer 2, a supplementary network layer, on top of Layer 1 to enhance scalability and efficiency. Layer 2 scaling solutions, such as Arbitrum and Optimism, already exist for Ethereum. By bundling transactions and reporting them back to Layer 1, these solutions reduce transaction data, improving Ethereum's scalability and capacity while leveraging its security features.

A new category of Layer 2 scaling solutions has emerged using Zero-knowledge proofs (ZKP), a cryptographic authentication method between two or more parties. It was once believed that this superior method would take at least a decade to develop, but we are there in half the time. Unlike traditional authentication processes that require shared passwords, ZKP authentication only needs proof of password knowledge without disclosing the actual password. For instance, a loan can be secured by proving an adequate credit score without revealing the actual score.

With the launch of zkSync Era, a leading ZKP Layer 2 solution, the blockchain landscape has entered a new phase. After four years of development, zkSync Era has become one of the first Ethereum Virtual Machine-compatible ZKP Layer 2 solutions. It enables faster, cheaper transactions by allowing the easy porting of most Ethereum DApps with minimal changes.

In competition with zkSync Era, Polygon, a leading blockchain company, has also released its ZKP Layer 2 solution. Approximately 32 to 50 projects, including Redstone, Balancer, Graph, and Pyth Network, went live on March 24. DeFi players such as Banxa, Chainlink, and Yearn Finance are also migrating to the network. These solutions significantly reduce costs and increase speed for blockchain technology, enabling a broader range of use cases. Blockchain technology continues its rapid evolution.

4. Web3 news you didn’t hear about:

FTX influencers Graham Stephan, Kevin Paffrath, and Andrei Jikh faced a $1B class-action lawsuit over alleged crypto fraud promotion.

Meta announced that it would end minting and selling NFTs on Instagram along with the feature of sharing NFTs on Instagram and Facebook in the next few weeks, citing a focus on other priorities.

The U.S. Commodity Futures Trading Commission (CFTC) has brought charges against Binance, the world's largest cryptocurrency exchange, and its CEO Changpeng "CZ" Zhao, accusing them of breaching regulations concerning trading and derivatives.

NFThing is a London-based creative technology production studio, building bespoke web3 experiences for creators and consumers, while fully respecting decentralisation and the web3 ethos. NFThing builds strategies and products in multiple areas from AR/VR to NFTs, crypto and blockchain technology. For more details visit: www.nfthing.com